Financial Planning for Teachers: Mastering Your Finances

UpKeepDay ensures the seamless operation of your online school while keeping your family content.

Do you want to take control of your financial situation as a teacher? This article serves as your guide to personal finance for online educators. We’ll explore how effectively managing lesson payments through UpKeepDay can lead you to financial stability. Get expert financial advice for teachers today.

This topic is particularly relevant given the considerable time it takes from generating an invoice to receiving payment. UpKeepDay offers a solution to automate these processes, allowing teachers to focus on preparing engaging learning materials and conducting dynamic lessons.

As a teacher, you deserve the best. Discover financial planning tips to optimize your budget and manage your resources effectively.

What is Teacher Financial Planning?

Financial planning for teachers is the process of managing finances that allows for wise financial stewardship, saving for the future, and rationally allocating funds for major purchases.

Teachers' financial planning is the key to well-being. Teachers often feel financial strain due to extra classroom expenses. So how can they balance personal expenses with student needs?

Here are some recommendations:

- Analyze Your Expenses: "There are no small amounts, only big goals." This saying is especially relevant when it comes to saving. Even small daily expenses can significantly impact your finances over a year. This money should be invested to ensure sustainable growth of your savings through the power of compound interest. Remember, even small steps lead to big changes. This is your teacher's savings plan.

- Create a Detailed Financial Plan: Plan your future by writing down your goals. These plans can be both short-term and long-term. Then, calculate how much money you need to achieve each goal and determine how much time you're willing to spend on it.

- Seek Additional Sources of Income: Another important piece of financial advice for teachers is to remember the possibility of involving parents, local businesses, and grants. Also, consider turning your hobbies into a business or finding summer side gigs.

This last point is especially relevant for teachers seeking advice on forums:

Use the information below to solve your financial problems.

Tips on How to Conduct Financial Planning as a Private Teacher

Consider the following financial advice tips and experience financial freedom as a teacher step by step:

- Optimize your budget: understand the terms of student loans, reduce insurance and credit card expenses.

- Invest in your future: learn about tax benefits for teachers, invest in a retirement fund, and explore additional income sources.

- Create a financial safety net: build an emergency fund and develop a budget.

- Overcome financial challenges: develop a debt repayment strategy.

- Take advantage of teacher-specific offers: discover discounts on insurance, travel, and essential goods.

- Invest in education: maximize your return on investment in your own education and professional development.

- Conduct financial planning for teachers: create a personalized plan using specialized tools and consultations.

Check out the UpKeepDay app, which helps educators manage payments from online lessons with students and serves as personal finance assistance for teachers.

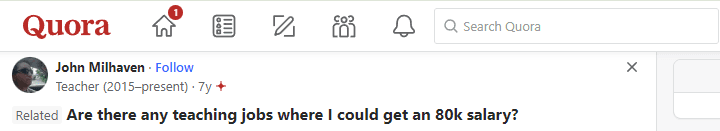

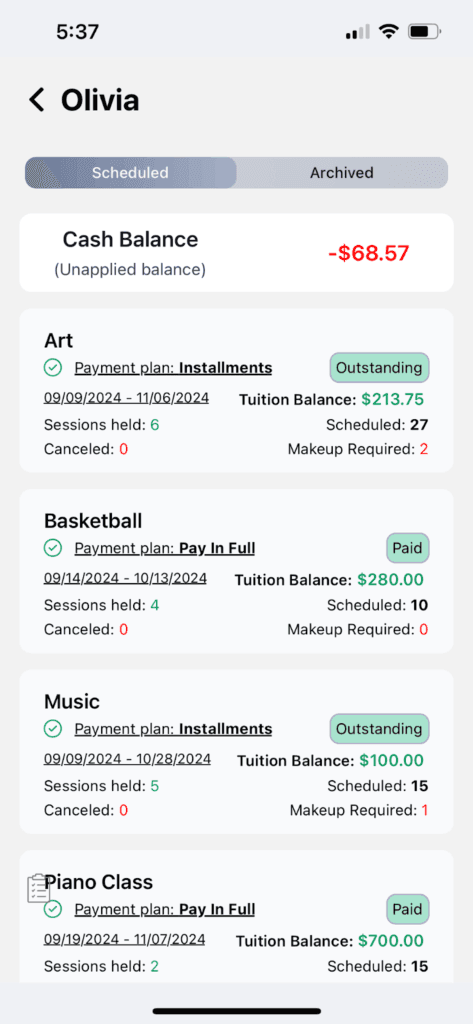

Instructors can set up flexible payment plans for their students, allowing them to choose from:

- full payment;

- installments;

- pay-as-you-go.

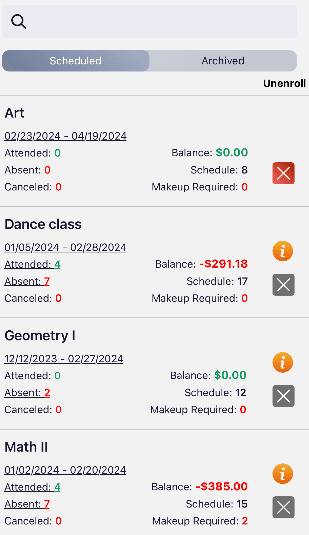

Invoices are generated automatically and categorized as unpaid, outstanding, or paid for user convenience.

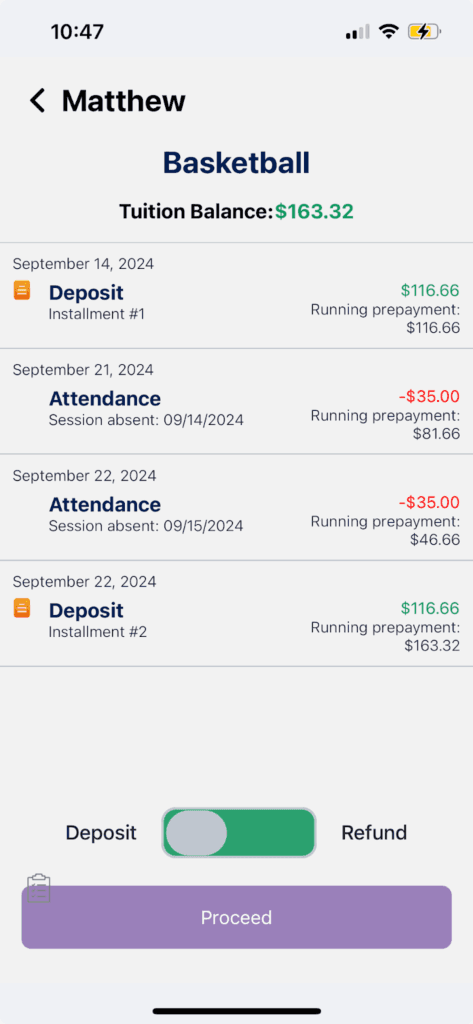

When students use UpKeepDay for processing payments, these transactions are automatically reflected as deposits for the instructors. Each attendance entry reduces the account balance, accurately representing the current financial status at any given moment.

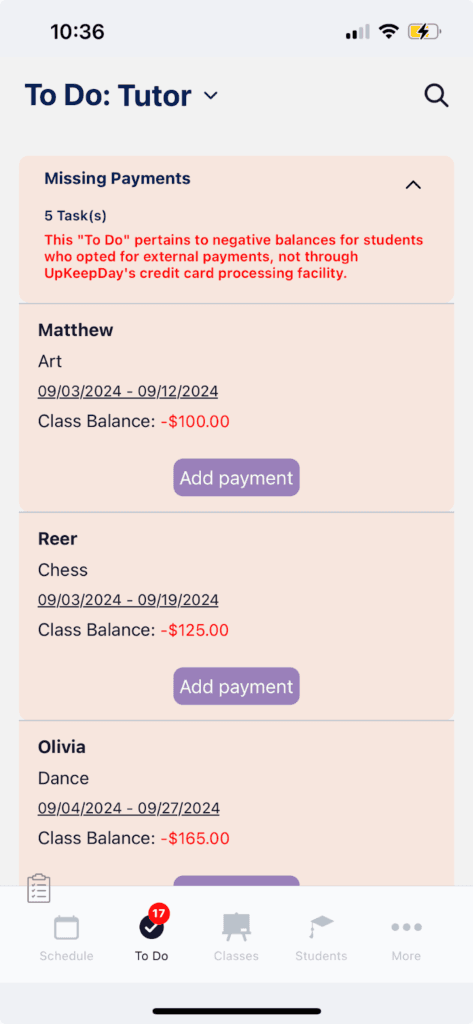

When a payment is missed, UpKeepDay automatically generates a task labeled “Missing Payment.” The details of the non-payment are recorded in the teacher's task list, enabling quick identification of students with outstanding balances.

Try this convenient financial planner for teachers.

UpKeepDay: The Ultimate Financial Control and Planning Tool for Tutors

The app provides efficient payment processing, serving as your personal finance teacher. You will be able to effortlessly track payments and invoices, ensuring timely and accurate financial management.

UpKeepDay's invoicing and payment processing features assist with financial planning for teachers by automating the billing process, tracking payments, and providing real-time financial reports. This streamlines revenue management, helps educators monitor income trends, and ensures timely payments, giving them better control over their finances without the need for manual tracking.